Amidst the ebbs and flows of the market, Joel Elconin and Blu Putnam, Managing Director and Chief Economist at the Chicago Mercantile Exchange, discussed the intricacies of bond yields, interest rates, and the specter of recession on the Closing Print show.

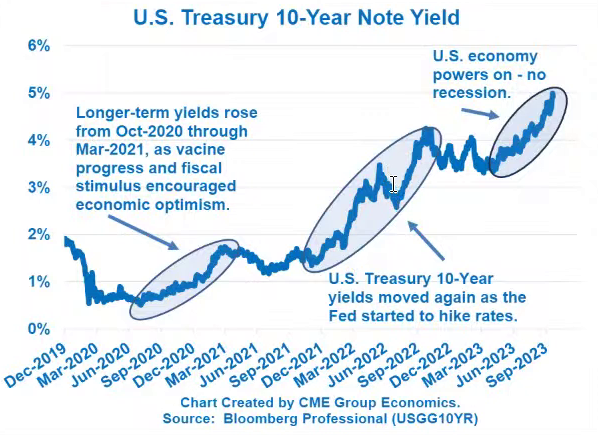

The discourse opened with a chart on the 10-Year Note (see below), portraying the journey of bond yields from below 1% to a peak of 5%. Putnam delineated this journey across three distinct phases: the pandemic-induced slump, the fiscal stimulus spur, and the Federal Reserve’s rate hikes. While recession fears loomed, the economy held steady in 2023, though Putnam hinted at a possible slowdown in 2024.

Bond yields mirrored the inflation and real GDP growth, finding a temporary plateau at 5%. However, Putnam’s caution against fixating on round numbers was clear; such fixations often breed market volatility.

A notable topic was the speculated trend towards stagflation. Putnam debunked this by comparing the current scenario with the 1970s stagflation period, underscoring the dissimilarities in unemployment and inflation rates. The narrative of the 70s, according to Putnam, was unique and far removed from the current market dynamics.

As the conversation veered towards the banking sector, concerns about the financial stability arose, particularly with some banks’ stocks trending downwards. However, Putnam reassured that the banks were well-capitalized, albeit their profitability might be under scrutiny.

As the dialogue wrapped up, the sentiment leaned towards cautious optimism rather than doom-and-gloom. The bond yields may be ringing alarm bells for some, but for seasoned analysts like Putnam, it’s a part of the market’s cyclical narrative. Through the lens of an investor, understanding these market tremors and the macroeconomic factors driving them is crucial for decision making for the short and long term.