Blu Putnam, former Chief Economist at the CME, joined PreMarket Prep to dissect the current macroeconomic landscape, emphasizing inflation trends, tariff impacts, and market expectations. His insights provided a comprehensive perspective on the forces driving economic sentiment and market volatility.

Key Insights from Blu Putnam

Inflation and the Fed’s Position

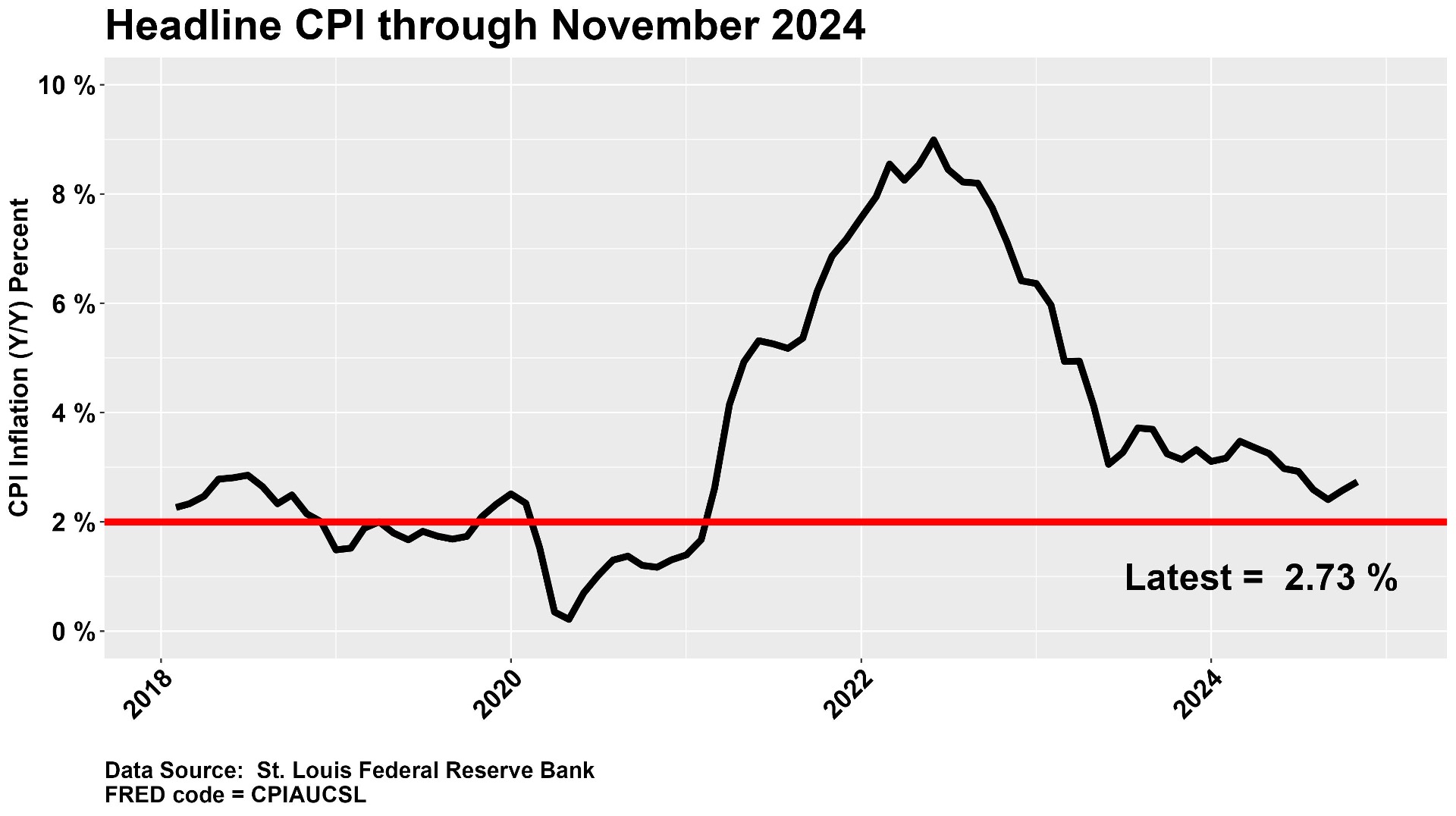

Blu started by addressing inflation trends and the Federal Reserve’s stance. He explained that although inflation has cooled, markets remain fixated on its lingering effects due to persistently low unemployment levels. Blu clarified:

- Producer Price Index (PPI) vs. Consumer Price Index (CPI): The PPI, which primarily tracks goods prices, showed volatility. However, Blu stressed that services inflation, reflected in the CPI, remains a bigger concern for the Fed.

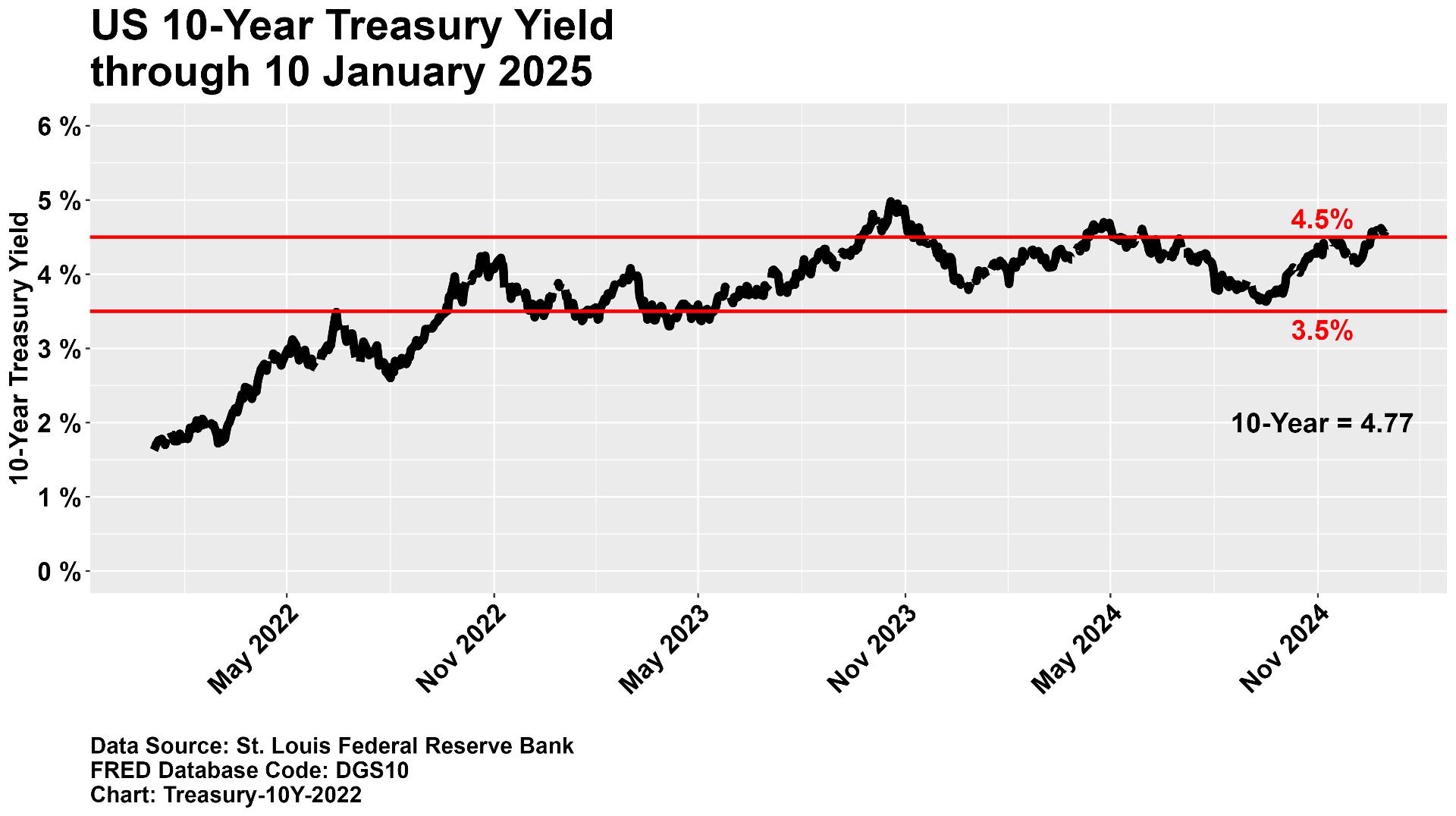

- Fed’s Hold on Rates: Blu believes the Fed is firmly positioned at its current rate levels (~4.75%) and will only pivot if there is a significant economic shock, such as a rise in unemployment.

He also commented, “We’re not seeing signs of a recession yet, and inflation is the primary focus for now.”

Tariff Uncertainty and Supply Chain Disruptions

A significant point of discussion was the anticipated tariff policies under the new administration. Blu highlighted:

- Short-term Impact: New tariffs could disrupt supply chains and production, leading to lower GDP growth initially.

- Long-term Effect: Tariffs contribute to inflation, as increased import costs push consumer prices higher.

He also noted that large retailers have already increased imports to brace for potential tariff hikes, which may cause inventory distortions in upcoming economic reports.

Crude Oil and Commodity Prices

The recent $10 spike in crude oil prices was a major point of interest:

- Blu thinks that this will eventually drive up retail gasoline prices, impacting headline CPI in the first quarter of the year.

- He also remarked that while energy and food prices are often excluded from core inflation calculations, they still weigh heavily on consumer sentiment and discretionary spending.

Immigration and Labor Market Tightness

Blu outlined the crucial link between immigration policy and inflation:

- Key Sectors Affected: Agriculture, hospitality, and construction heavily rely on immigrant labor. Restrictive immigration policies can lead to labor shortages, reducing output and driving wages higher.

- Inflationary Pressures: The labor constraints caused by tighter immigration policies may initially dampen productivity but later lead to wage inflation.

The Bond Market and the Yield Curve

Blu thinks that until we see unemployment rising, market participants shouldn’t expect the 10-year to break out of its current range.

- 10-Year Yield Outlook: Blu projected the 10-year bond yield to stay within the 4.5% to 5% range unless a significant economic shift occurs.

- Market Reaction: Investors chasing short-term fluctuations in bond yields may end up misaligned, as Blu sees stability in nominal GDP growth (real GDP + inflation) anchoring these rates.

Market Sentiment and Equities

Blu expressed caution about the equity markets. Despite concerns, Blu advocated for public equities, real estate, and cash, citing their liquidity advantages over private equity. He argued that the current environment rewards liquidity rather than locking up funds in long-term, illiquid investments. “The era of zero-interest rates favored private equity, but now liquidity commands a premium.”

Key Recommendations for Long-Term Investors

Blu offered straightforward points for long-term investors:

- Stay Calm: Inflation levels between 2.5% and 3% do not warrant panic.

- Focus on Macro Signals: Pay attention to major shifts in monetary and fiscal policy rather than short-term data fluctuations.

- Diversified Allocation: Blu currently maintains a balanced portfolio that includes equities, some real estate exposure, and cash for flexibility.

Summary of Blu’s Outlook

Blu believes that the U.S. economy is navigating a “serious transition” period, where policy changes and geopolitical risks could cause short-term turbulence. However, with the Fed maintaining its current rate stance and no recession on the horizon, his overall tone remained cautiously optimistic. Blu highlighted the importance of remaining adaptable and vigilant amid evolving market dynamics. In conclusion, Blu’s strategic allocation emphasizes liquidity and resilience as the economy continues to adjust to a new equilibrium of interest rates, inflation, and policy shifts.