In a recent discussion on The PreMarket Prep show, Jim Tassoni, Senior Consultant at MDRN Capital and CIO of Armor Wealth Strategies, joined Dennis Dick, Joel Elconin, and Aaron Bry to shed light on the current state of market volatility. The conversation delved into various critical topics, including yield curve inversion, the unwinding of the Japanese Yen (JPY) and U.S. Dollar (USD) carry trade, and specific trading strategies for SPY, IWM, and MRNA. This article will explore Jim’s insights, as well as his outlook on near to medium-term market conditions.

Understanding Yield Curve Inversion and Market Implications

Jim Tassoni kicked off the discussion by highlighting the yield curve inversion, a phenomenon where short-term interest rates surpass long-term rates. Historically, yield curve inversions have been seen as a precursor to economic recessions. Tassoni pointed out that the last time the yield curve was inverted for such an extended period (19 months) was in 2007, just before the 2008 financial crisis. However, he emphasized that while the current inversion is concerning, it does not necessarily indicate an imminent meltdown akin to 2008. The key takeaway is that investors should remain cautious and aware of their surroundings, as the economic landscape remains uncertain.

JPY/USD Correlation and Market Indicators

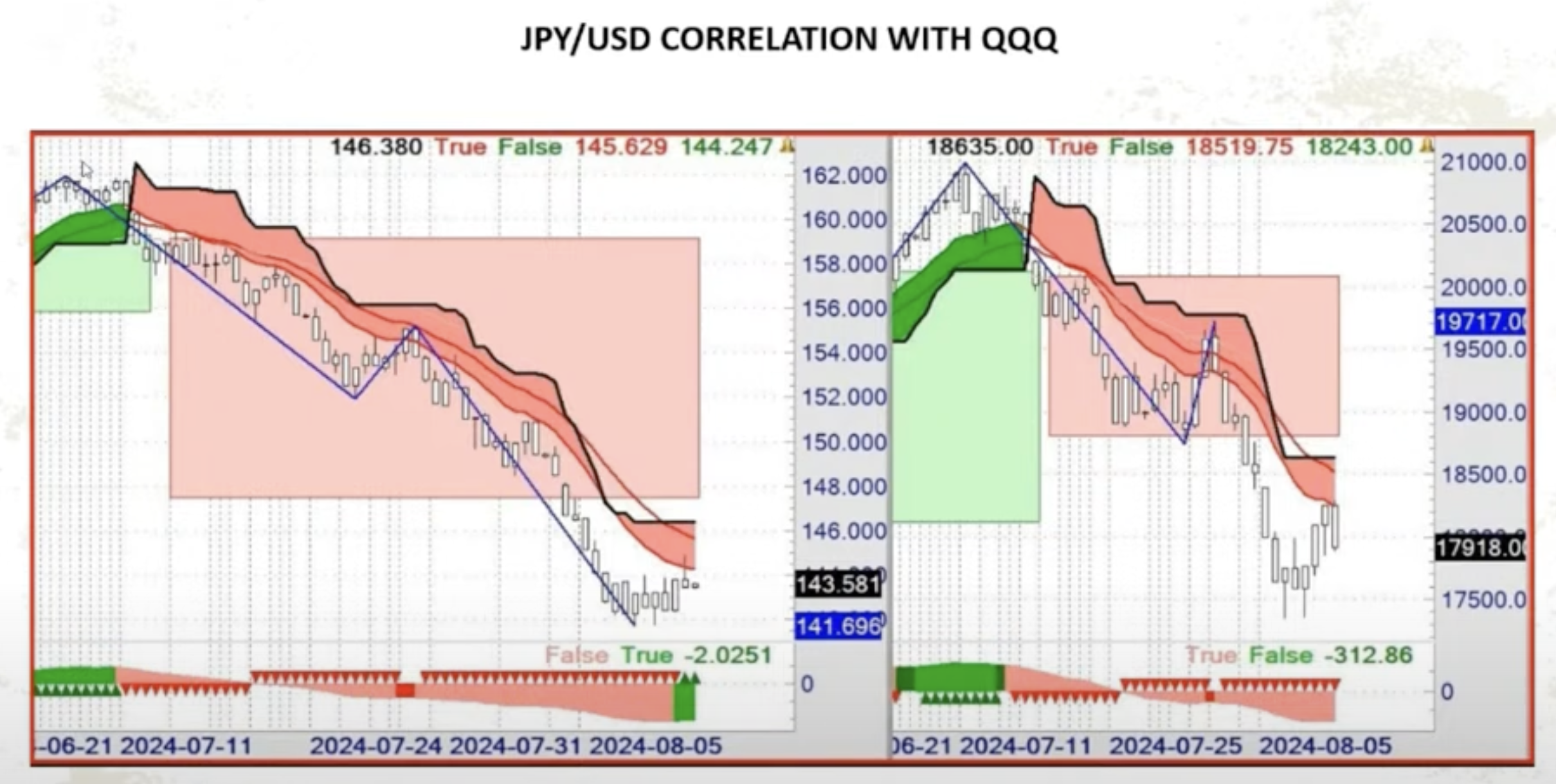

The conversation then shifted to the correlation between the JPY/USD pair and the broader market, particularly the Invesco QQQ Trust (NASDAQ: QQQ). Tassoni noted that there has been a significant correlation between the yen carry trade and market movements in recent months, especially with the recent drop as the carry trade unwinds. For traders, monitoring the Japanese Yen futures (CME: 6JW00) can serve as an important indicator, helping to confirm trades or signal potential pivots in market direction.

Further discussing the JPY/USD carry trade, Jim speculated there could be anywhere from some billions to hundreds of billions of dollars tied up in a trade of this form. Beyond the QQQ’s, this could also impact treasuries and other instruments as the trade unwinds, and Tassoni’s take is that it could mean another 8-10% of downside but not a 30-40% crash.

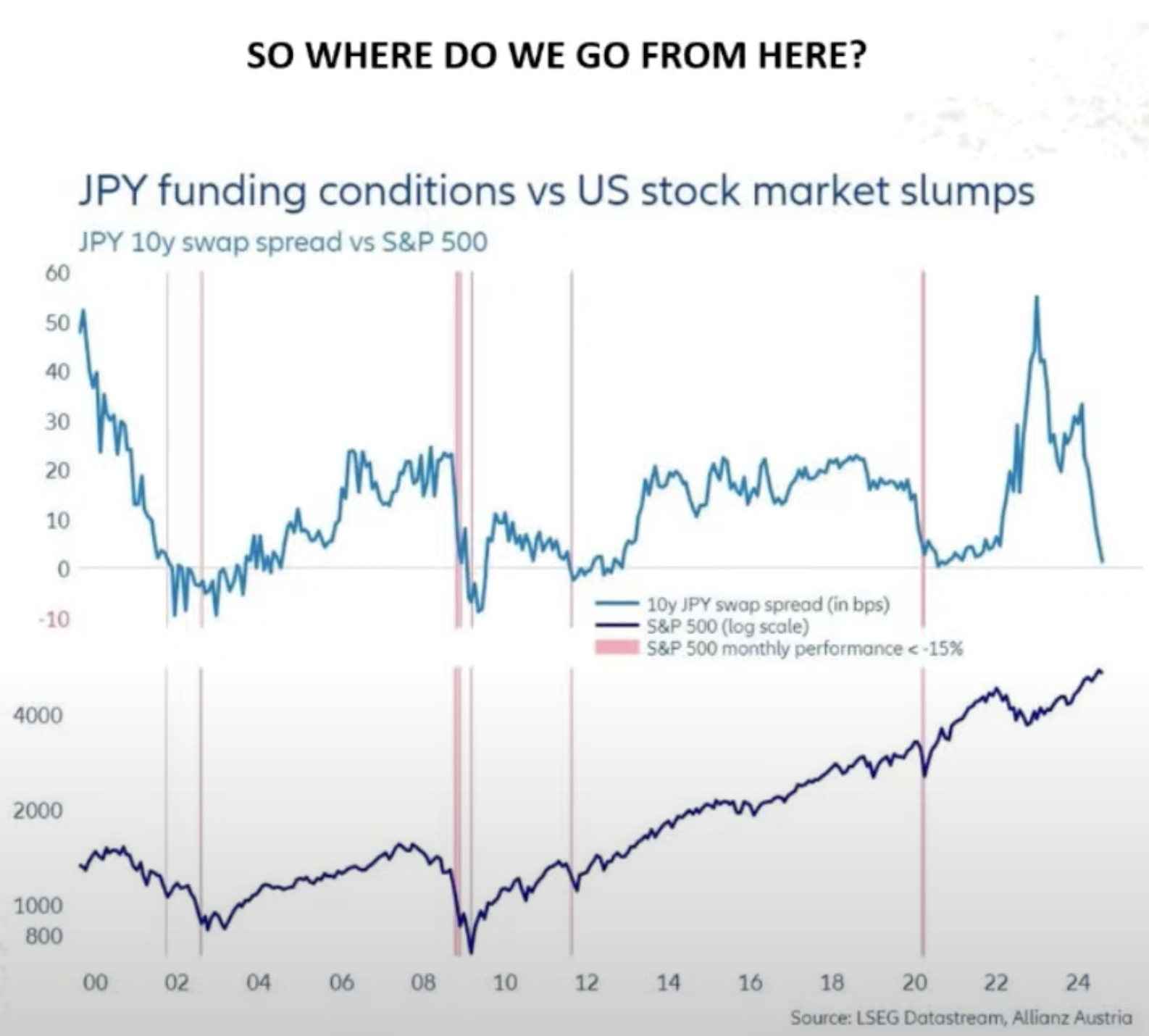

Tassoni also discussed the historical context of yen carry trade blowouts, noting that similar events in the past (such as in 2002, 2008/09, and 2020 indicated in the above chart) led to material downturns in the S&P 500. While the current situation may not lead to a dramatic sell-off, he advised traders to tread cautiously, as there could be more downside ahead.

Potential Trades: SPY, IWM, and MRNA

SPDR S&P 500 ETF Trust (NYSE: SPY)

Tassoni expressed a fairly neutral stance on the S&P 500 but suggested a potential dip-buy trade setup. He is looking for a retest of the $510 level, emphasizing the importance of a retest and confirmation before entering a long position. If SPY holds this level on a daily close, it could present an opportunity for a move higher. However, he plans on placing a stop-loss if SPY closes below $495 to manage risk.

iShares Russell 2000 ETF (NYSE: IWM)

Tassoni is bearish on the Russell 2000 due to its structure, where a majority of the index comprises unprofitable companies. He mentioned that if the IWM sees a bounce, it could be an opportunity to short the index, anticipating further downside.

Moderna, Inc. (NASDAQ: MRNA)

On Moderna, Tassoni expressed a bearish outlook, arguing that the company’s strong performance during the COVID-19 pandemic is unlikely to be sustained. With declining demand for vaccines and fierce competition from large pharmaceutical companies, he views a rally in Moderna as a potential shorting opportunity. The fundamental challenges facing Moderna make it a less attractive long-term investment in his view.

Near-Term Market Outlook

Summarizing his thoughts on the broader market, Jim Tassoni stressed the importance of remaining vigilant and cautious in the face of ongoing volatility. The yield curve inversion, JPY/USD correlation, and specific trade setups all point to a market environment that could see additional downside pressure. While he does not foresee a catastrophic collapse, he advises traders and investors to carefully select their entry points and be prepared for potential market fluctuations.